The Future of Token Farming in the Crypto World

UR

Understanding Token Farming

Token farming, also known as yield farming, has become a cornerstone of the cryptocurrency ecosystem. It involves staking or lending crypto assets to generate high returns or rewards in the form of additional cryptocurrency. As the crypto landscape evolves, understanding token farming is essential for both new and seasoned investors.

The concept of token farming gained traction with the rise of decentralized finance (DeFi) platforms. These platforms enable users to participate in liquidity pools, where they can earn interest, fees, or new tokens. This process has democratized financial opportunities, allowing anyone with internet access to benefit from their crypto holdings.

The Evolution of Token Farming

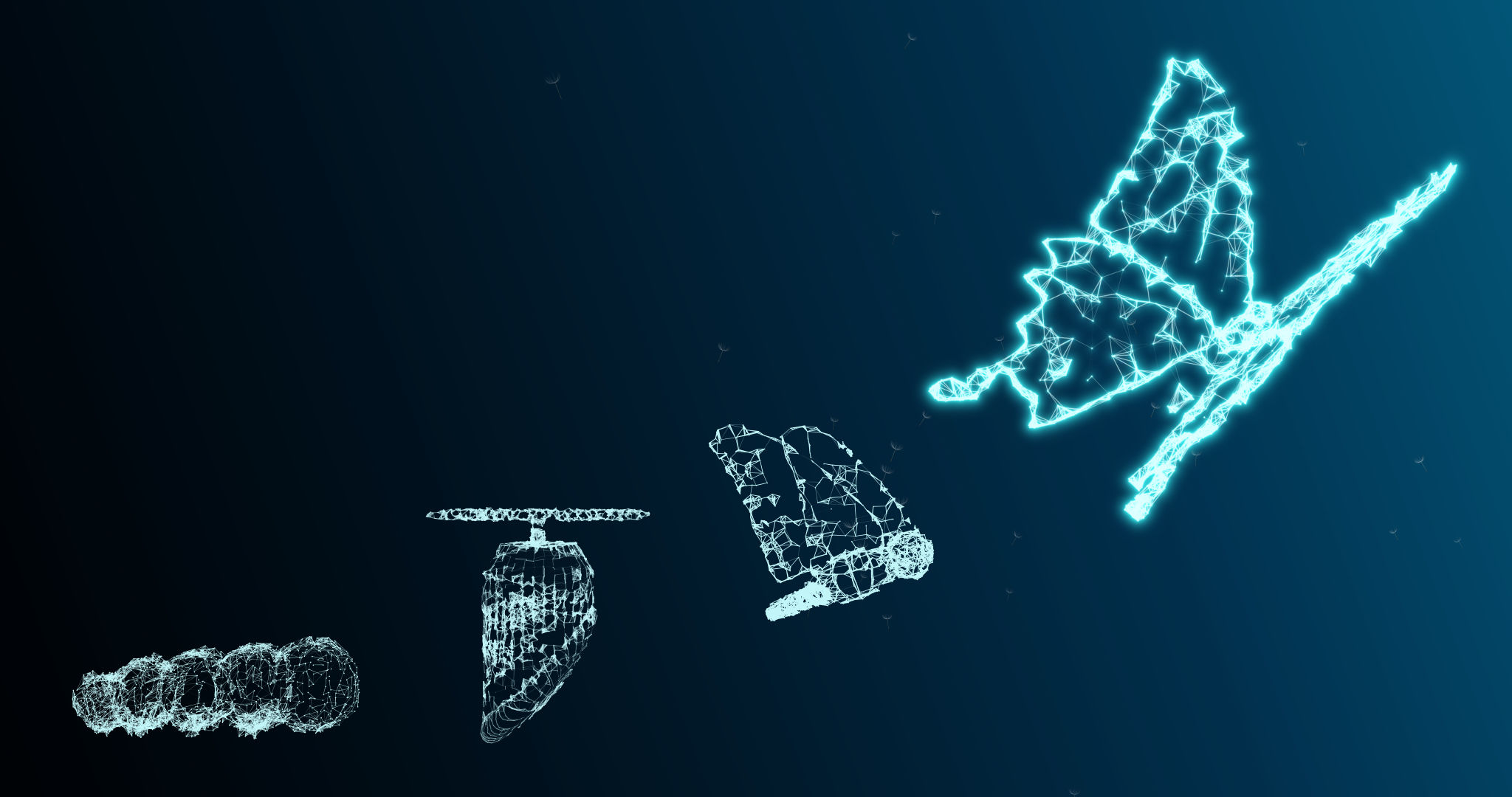

Since its inception, token farming has undergone significant transformations. Initially dominated by Ethereum-based platforms, the practice has expanded to other blockchains like Binance Smart Chain and Solana, each offering unique advantages such as lower transaction fees and faster processing times.

Moreover, the strategies within token farming are evolving. From simple staking models to complex liquidity provision and arbitrage strategies, users have an array of options to maximize their returns. This evolution is driven by increased competition among DeFi platforms, prompting innovation and better opportunities for yield farmers.

Challenges Facing Token Farmers

Despite its lucrative potential, token farming is not without challenges. One of the primary concerns is **impermanent loss**, which occurs when the price of staked assets changes compared to when they were deposited in a liquidity pool. Additionally, smart contract vulnerabilities pose significant risks, as shown by numerous hacks and exploits in recent years.

Regulatory uncertainty also looms over the future of token farming. As governments worldwide grapple with how to regulate cryptocurrencies and DeFi platforms, potential changes in legislation could impact how token farming operates, affecting both platforms and users alike.

The Role of Technology in Shaping the Future

Technological advancements are expected to play a crucial role in the future of token farming. The integration of artificial intelligence and machine learning can provide more efficient and secure farming strategies. These technologies could help in identifying optimal farming opportunities and managing risks more effectively.

Furthermore, the development of cross-chain interoperability will likely enhance the flexibility and accessibility of token farming. By allowing seamless interactions between different blockchains, users can take advantage of diverse opportunities without being restricted to a single platform.

Opportunities for New Entrants

The continued growth and maturation of the token farming sector present substantial opportunities for new entrants. For individuals looking to engage in token farming, gaining a thorough understanding of the market dynamics and staying informed about industry trends is essential.

To get started, potential yield farmers should consider the following steps:

- Research various DeFi platforms to find ones that align with their investment goals.

- Evaluate the risks associated with different farming strategies.

- Stay updated with regulatory changes that might affect their activities.

The Future Outlook

The future of token farming looks promising as more people recognize its potential for generating passive income. With ongoing innovation and adaptation within the crypto ecosystem, yield farming is poised to remain a vital component of decentralized finance.

As new projects emerge and existing platforms refine their offerings, the world of token farming will likely become more sophisticated and accessible. By embracing technological advancements and navigating challenges carefully, investors can maximize their opportunities in this dynamic landscape.