How to Maximize Your Returns with REDFF Token Farming

UR

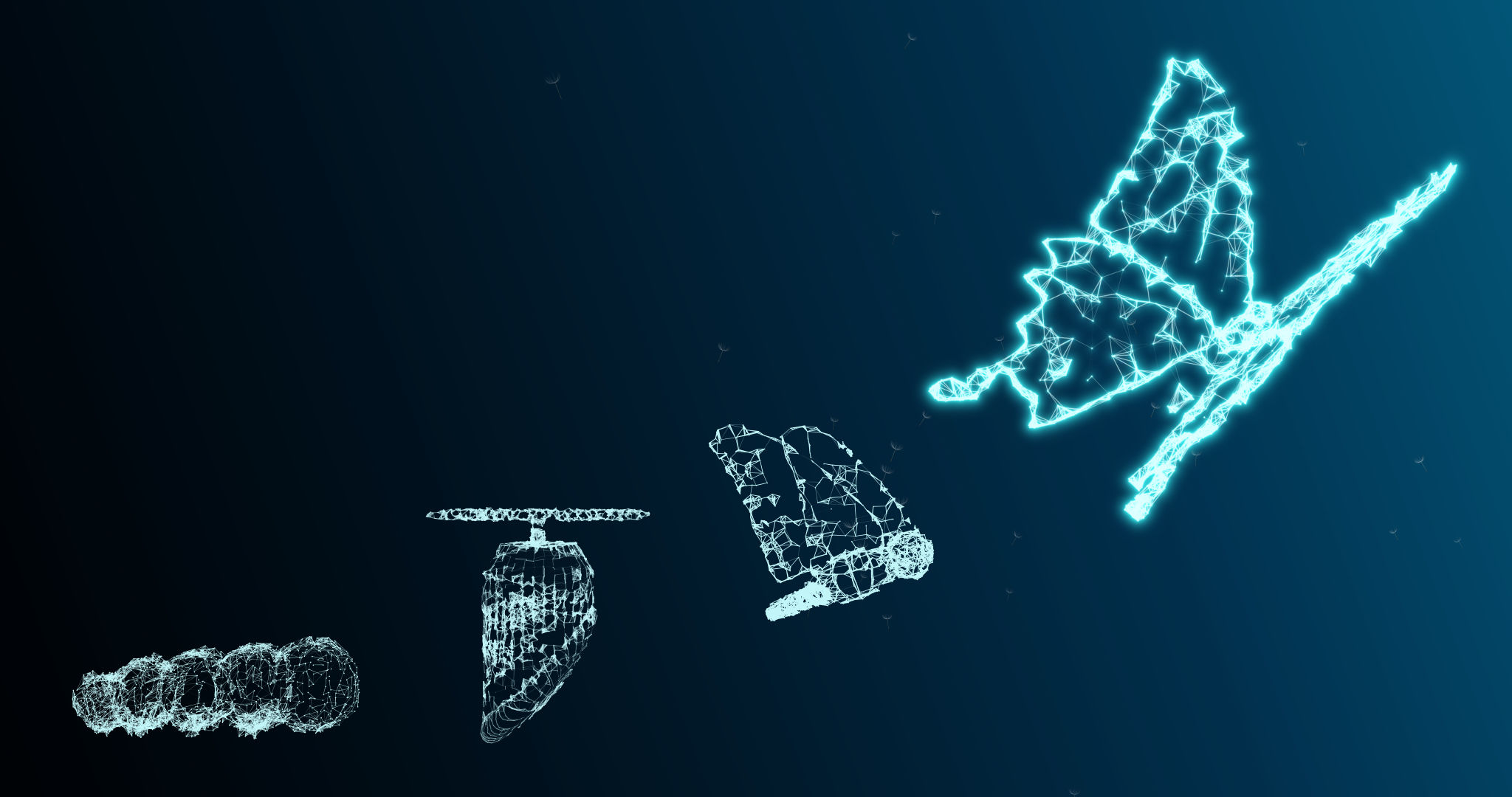

Understanding REDFF Token Farming

REDFF token farming is an innovative way to earn passive income in the cryptocurrency space. By staking or providing liquidity with REDFF tokens, investors can earn rewards over time. This process allows you to maximize your returns by engaging actively with the blockchain’s ecosystem.

Getting Started with REDFF Token Farming

To begin, you need to purchase REDFF tokens through a reputable exchange. Once you have acquired the tokens, you can choose to stake them or provide liquidity in a decentralized finance (DeFi) platform that supports REDFF. Ensure that you are familiar with the platform's terms and conditions to avoid any mishaps.

Selecting the Right Platform

Choosing the right platform is crucial for maximizing your returns. Look for platforms that offer competitive Annual Percentage Yields (APY) and have a strong community presence. It’s also important to consider the platform's security features and reputation in the market. Conduct thorough research and read user reviews before committing your tokens.

Strategies for Maximizing Returns

To optimize your earnings, it's essential to employ strategic approaches. Consider diversifying your investments across different platforms and pools. This diversification can mitigate risks and potentially increase your overall returns. Additionally, keep track of market trends and adjust your strategies accordingly.

Reinvesting Rewards

Reinvesting your earned rewards back into farming can compound your returns over time. By continuously staking rewards or adding them to your liquidity pools, you can take advantage of the power of compound interest, significantly boosting your earnings in the long run.

Monitoring Market Trends

The cryptocurrency market is highly volatile, making it crucial to stay informed about the latest trends and developments. Regularly monitoring market conditions can help you make informed decisions about when to stake, unstake, or shift your investments. Use reliable news sources and analytical tools to keep yourself updated.

Risk Management

While REDFF token farming offers lucrative opportunities, it also comes with risks. Smart contract vulnerabilities, market volatility, and platform failures are some potential challenges. To manage these risks effectively, consider setting stop-loss limits and not investing more than you can afford to lose.

Utilizing Community Resources

Engaging with community forums and discussions can provide valuable insights and support. Many experienced investors share their strategies and experiences, which can be beneficial for newcomers. Participating in these communities can also help you stay updated on any changes or updates related to REDFF token farming.

Conclusion

REDFF token farming can be a rewarding venture if approached strategically and cautiously. By understanding the process, selecting the right platforms, employing smart strategies, and managing risks effectively, you can maximize your returns and enjoy the benefits of this innovative financial opportunity.