Farming and Liquidity: Maximizing Returns with Red FinFox Tokens

UR

Understanding Farming and Liquidity in the Crypto World

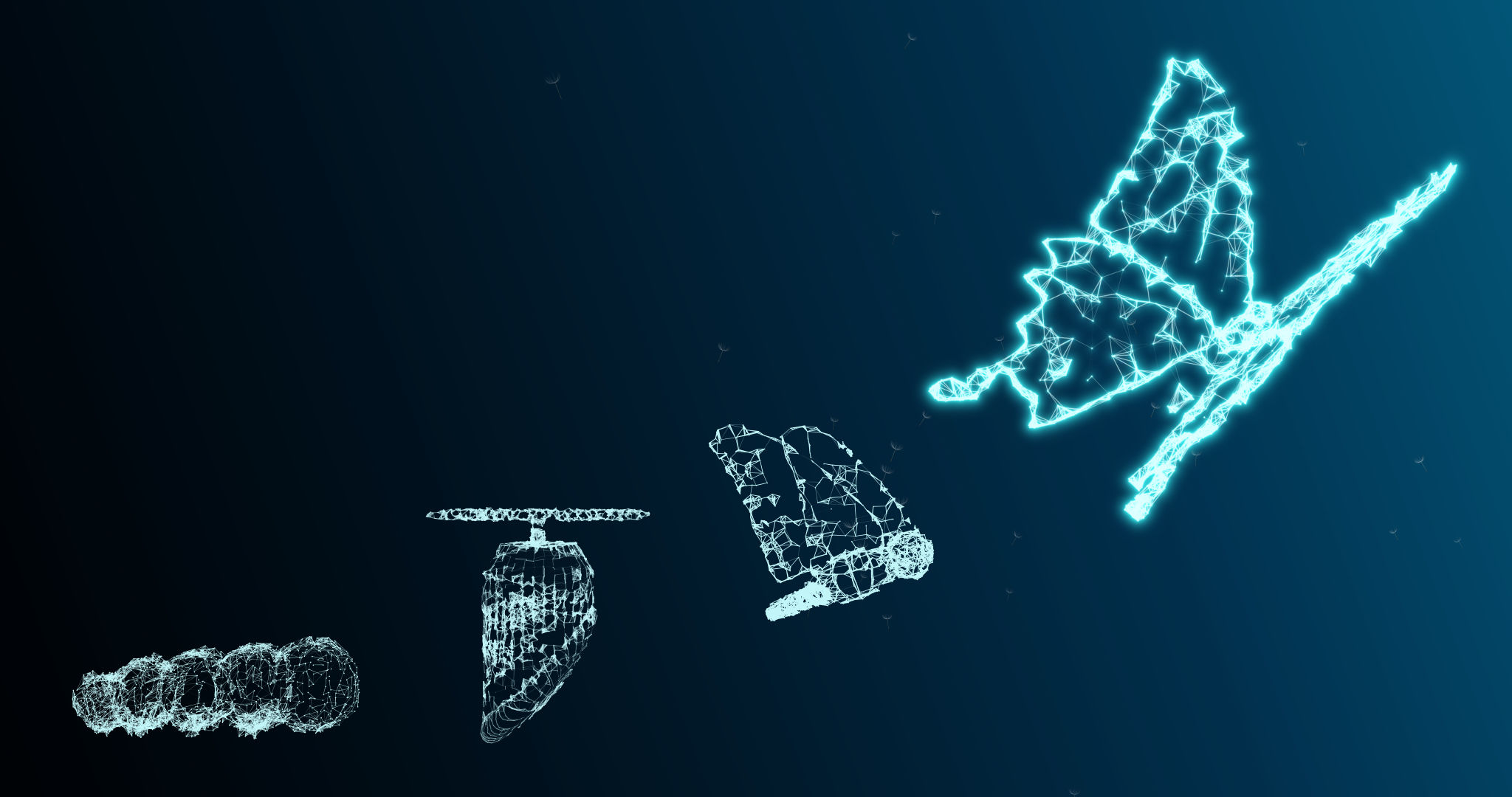

In the fast-evolving landscape of cryptocurrency, farming and liquidity are two terms that have gained significant attention. They are pivotal in maximizing returns on investments, especially with the advent of innovative tokens like Red FinFox. Understanding these concepts is crucial for anyone looking to optimize their crypto portfolio.

Farming, often referred to as yield farming, involves lending your cryptocurrencies in exchange for interest or additional tokens. This process allows you to earn passive income by participating in various blockchain protocols. Liquidity, on the other hand, refers to how easily an asset can be converted into cash without affecting its market price. In the context of crypto, providing liquidity means supplying your assets to decentralized exchanges (DEXs) to facilitate trading.

The Role of Red FinFox Tokens

Red FinFox Tokens have emerged as a promising option for investors looking to engage in farming and liquidity provision. These tokens are designed to offer enhanced returns through innovative mechanisms. By participating in farms or liquidity pools using Red FinFox Tokens, users can benefit from high yields that surpass traditional investment avenues.

One of the key advantages of using Red FinFox Tokens is their versatility. They are compatible with a variety of decentralized finance (DeFi) platforms, allowing investors to diversify their strategies. Whether you're interested in staking, lending, or participating in liquidity pools, Red FinFox provides ample opportunities to maximize your earnings.

Strategies for Maximizing Returns

To fully leverage the potential of Red FinFox Tokens, it's important to adopt effective strategies. Here are a few tips:

- Research Platforms: Always conduct thorough research before choosing a platform for farming or providing liquidity. Look for platforms with a strong reputation and robust security measures.

- Diversify Investments: Spread your investments across different platforms and pools to mitigate risks.

- Monitor Market Trends: Stay informed about market trends and adjust your strategies accordingly to capitalize on new opportunities.

By implementing these strategies, investors can enhance their returns while minimizing potential risks associated with volatility in the crypto market.

Navigating Risks in Farming and Liquidity

While the potential for high returns is enticing, it's important to be aware of the risks involved in farming and liquidity provision. Market volatility can impact the value of your assets, and smart contract vulnerabilities could pose security risks. Therefore, it's essential to have a risk management plan in place.

Consider setting stop-loss limits and regularly reviewing your portfolio to ensure alignment with your financial goals. Additionally, staying updated on the latest developments and security practices in the DeFi space can help safeguard your investments.

The Future of Red FinFox Tokens

As the DeFi ecosystem continues to evolve, Red FinFox Tokens are poised to play a significant role in shaping the future of farming and liquidity provision. Their innovative features and strong community support make them a valuable addition to any crypto portfolio.

Investors who stay informed and adapt to the dynamic landscape will likely reap substantial rewards. By embracing Red FinFox Tokens and employing strategic approaches, individuals can maximize their returns and contribute to the growth of decentralized finance.